A Goods and Services Tax (GST) certificate is a legal document issued by the government of India, certifying that the entity has been registered under the GST Act. It is mandatory for businesses with an annual turnover of more than Rs. 20 lakhs (Rs. 10 lakhs for northeastern and hilly states) to obtain a GST registration. A GST certificate contains important information such as the GSTIN (Goods and Services Tax Identification Number), the name and address of the business, and the date of registration. In this article, we will discuss the GST certificate sample and its various aspects.

Apply Now GST Certificate Online ( ⭐⭐⭐⭐⭐ 4.5 / 5 Rating Service | ✅ Hassle Free Documentation | ✅ Best Customer Support | ✅ Lowest Cost | ✅ Online Verified Process )

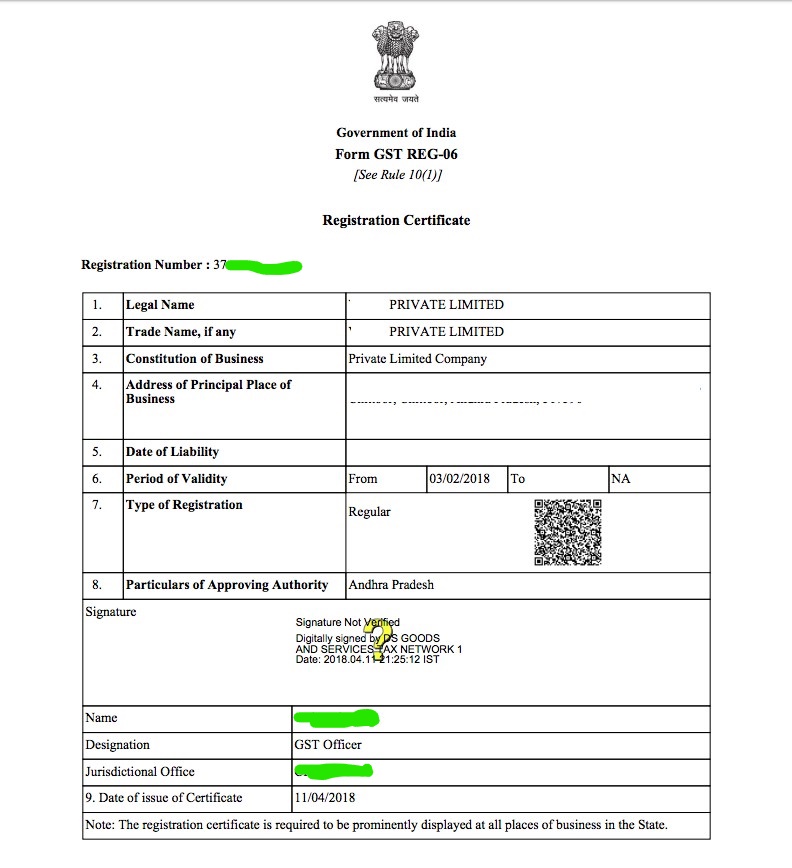

GST Certificate Sample:

A GST certificate is issued in Form GST REG-06, which can be downloaded from the GST portal. The certificate contains the following information:

- GSTIN: The Goods and Services Tax Identification Number (GSTIN) is a unique 15-digit number assigned to each registered business entity. It is the most important information on the certificate and should be checked for accuracy.

- Name and Address: The certificate contains the name of the business entity as well as its address as provided during the registration process.

- Date of Registration: The certificate displays the date on which the business entity was registered under GST.

- Type of Registration: The certificate indicates the type of registration under GST, which can be regular, composition, or casual taxable person.

- Principal Place of Business: The certificate mentions the principal place of business of the registered entity.

- Validity: The certificate specifies the validity period of the registration.

- Signature: The certificate is digitally signed by the authorized signatory of the tax department.

Importance of GST Certificate:

A GST certificate is a legal document that serves as proof of registration under the GST Act. It is essential for businesses to have a valid GST certificate as it enables them to:

- Collect and remit GST: A business entity can collect GST from its customers only if it has a valid GST registration certificate. The GST collected from customers must be remitted to the government within the prescribed timelines.

- Claim Input Tax Credit: A business entity can claim input tax credit (ITC) only if it has a valid GST certificate. ITC is the credit that a business entity can claim on the GST paid on inputs used in the production of goods or services.

- Participate in E-commerce: E-commerce platforms require their vendors to have a valid GST certificate in order to sell their products on the platform.

- Establish Credibility: A GST certificate provides credibility to the business entity as it indicates that the entity has complied with the provisions of the GST Act.

Apply Now GST Certificate Online ( ⭐⭐⭐⭐⭐ 4.5 / 5 Rating Service | ✅ Hassle Free Documentation | ✅ Best Customer Support | ✅ Lowest Cost | ✅ Online Verified Process )

FAQs:

Q: What is the validity of a GST certificate?

Ans: The validity of a GST certificate is usually for a period of 5 years. However, the certificate may be cancelled or surrendered by the registered entity before the expiry of the validity period.

Q: Can a business entity apply for multiple GST registrations?

Ans: Yes, a business entity can apply for multiple GST registrations if it has multiple business verticals in different states.

Q: Is it mandatory to have a GST registration for all businesses?

Ans: No, it is not mandatory for all businesses to have a GST registration. Only businesses with an annual turnover of more than Rs. 20 lakhs (Rs. 10 lakhs for northeastern and hilly states) are required to obtain a GST registration.

Q: How long does it take to obtain a GST certificate?

Ans: The time taken to obtain a GST certificate depends on the completeness and accuracy of the application. On average, it takes around 7-10 working days to obtain a GST certificate.