Online GST Registration

Fill the Application for Apply for New GST Registration

Process For Online GST Registration

1. Fill Up Application Form

2. Submit & Make Online Payment

3. Executive Will Process Application

4. Receive Certificate on Mail in 3 Days.

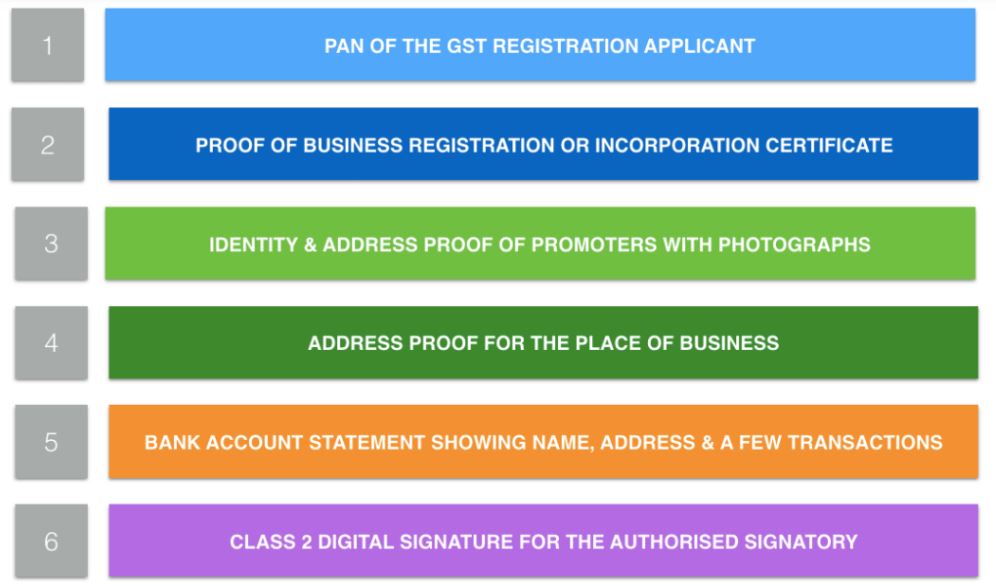

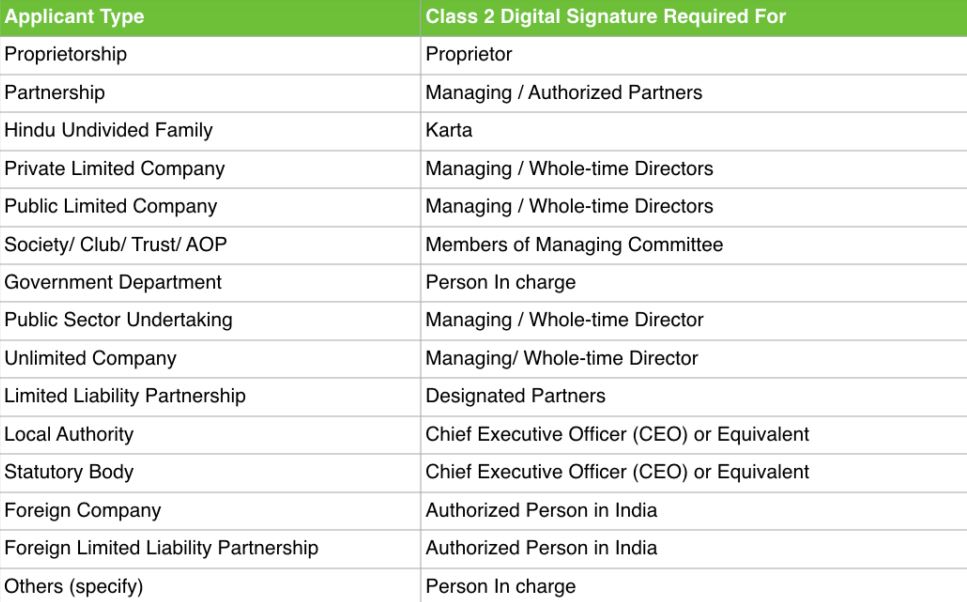

Documents Required For GST Registration

How to Register for GST:

Everyone is liable to get registered and seeking voluntary registration shall, before applying for registration, declare his permanent account number, mobile number, email address, state or Union territory in part A of form GSTR1 on GST common portal.

Registration process is divided into following steps :

- Step 1. Pan, mobile number and email are validate.

- Step 2. Pan validated online by common portal from Central Board of Direct Tax(CBDT) database.

- Step 3. Mobile number and email address verified through one time password sent to it.

- Step 4. Temporary reference number (TRN) is generated and communicated to the applicant on the given/mentioned mobile number and email id.

- Step 5. Using Temporary Reference Number(TRN), applicant shall electronically submit application in part II of application form, along with specified documents at the common portal.

- Step 6. On receipt of such application, an acknowledgment in the prescribed form shall be issued to the applicant within 15 minutes.

- Step 7. After submitting the application proper officer examined the application and accompanying documents.

- Step 8. Designated Officer will Grant registration certificate in form GST REG 06. If Satisfied with the submitted documents.

Contact Us

Statics

FAQ's

Under any taxation law, registration is the most fundamental requirement for identification of taxpayers ensuring tax complaints in the economy. It is the 1st step towards becoming GST compliant. Under Indirect tax regime, without registration, a person can neither collect tax from his customer nor claim any credit of tax paid by him. Under GST law, a supplier is required to obtain statewide’s registration. There is no concept of a centralized registration under GST like the ost well service tax resign. A supplier has to obtain registration in every state or Union territory from where he makes a taxable supply provided his aggregate turnover exceeds a specified threshold limit. Thus, he is not required to obtain registration from a state or Union territory from where he makes a non taxable supply .

If a business operates from more than one state, then a separate GST registration is required for each state. For instance, If a sweet vendor sells in Karnataka and Tamil Nadu, he has to apply for separate GST registration in Karnataka and TN respectively.

A business with multiple business verticals in a state may obtain a separate registration for each business vertical.

Small businesses having an annual turnover less than Rs. 1.5 crore** ( Rs. 75 Lakhs for NE States) can opt for Composition scheme.

**CBIC has notified the increased in the threshold turnover for opting into the Composition Scheme from Rs 1 crore to Rs 1.5 crores. The notification will be effective from 1st April 2019.

Composition dealers will pay nominal tax rates based on the type of business:

- Composition dealers are required to file only one quarterly return (instead of three monthly returns filed by normal taxpayers).

- They cannot issue taxable invoices, i.e., collect tax from customers and are required to pay the tax out of their own pocket.

- Businesses that have opted for Composition Scheme cannot claim any Input Tax Credit.

Composition scheme is not applicable to :

- Service providers

- Inter-state sellers

- E-commerce sellers

- Supplier of non-taxable goods

- Manufacturer of Notified Goods

This scheme is a lucrative option for all SMEs who want lower compliance and lower rates of taxes under GST.

A GST taxpayer whose turnover is below Rs 1.5 crore** can opt for Composition Scheme. In case of North-Eastern states and Himachal Pradesh, the present limit is Rs 75 lakh.

Turnover of all businesses registered with the same PAN should be taken into consideration to calculate turnover.

**CBIC has notified the increased in the threshold turnover for opting into the Composition Scheme from Rs 1 crore to Rs 1.5 crores. The notification will be effective from 1st April 2019. Learn the Rules about Composition scheme & Know the pros & cons of being a composition dealer.

Obtain GST registration and file CMP-02 to opt-in for the scheme.

A. For normal registered businesses:

- Take input tax credit

- Make interstate sales without restrictions

- To know more about the Benefits of GST

B. For Composition dealers:

- Limited compliance

- Less tax liability

- High working capital

- To know more about composition scheme

C. For businesses that voluntarily opt-in for GST registration (Below Rs. 40 lakhs*)

- Take input tax credit

- Make interstate sales without restrictions

- Register on e-commerce websites

- Have a competitive advantage compared to other businesses

- To know more about voluntary registrations

*CBIC has notified the increase in threshold turnover from Rs 20 lakhs to Rs 40 lakhs. The notification will come into effect from 1st April 2019.

As we have seen that supplier is liable to be registered under GST in the state or Union territory from where he makes the taxable supply of goods and/or services only if applicant exceeds the applicable threshold limit in a financial year. However there are certain cases where in a supplier is mandatory required to obtain registration irrespective of the quantum of his aggregate turnover.

As we have seen that supplier is liable to be registered under GST in the state or Union territory from where he makes the taxable supply of goods and/or services only if applicant exceeds the applicable threshold limit in a financial year. However there are certain cases where in a supplier is mandatory required to obtain registration irrespective of the quantum of his aggregate turnover.

Category of persons requiring compulsory registration under GST have been Listed below:

1. Person making any interested taxable supply.

2. Casual taxable person making taxable supply.

3. Person who are required to pay tax under rivers charge on inward supplies received.

4. Non resident taxable person making the taxable supply.

5. E-commerce operator.

6. Person who are required to deduct tax under section 51 coma whether or not separately registered under this act.

7. Person who makes the taxable supply of goods/services/both on behalf of other taxable persons whether as an agent or otherwise.

8. Input service distributor(ISD), whether or not separately registered under this act.

9. Everyone supplying online information(IT INFO.) and database access or retrieval service from a place outside India to a person in India, other than registered person.

10. Person who are required to pay tax under reverse charge mechanism under section 9(5) and

11. Such other person or class of persons as may be notified by the government on the recommendation of the council.